It’s as easy as 1-2-3!

Experience Your Amazing New Auto Insurance Experience in Just 5 Minutes!

Provide Information

By answering just a few quick questions, we’ll be able to build a tailor-made profile just for you and your vehicle of choice.

Compare between best policies

Tell us about yourself and your car , and our experts will find the perfect match: an insurance policy that gives you everything you want at a price you can afford.

Make an educated choice

Getting great auto insurance should not be frustrating or confusing. Let us help you make the smart choice to save you money without wasting your time!

Dare to Compare!

Have you ever heard the old phrase that money equals power? We see it all over the place – CEOs, athletes, celebrities, the list goes on and on. Well the reverse is true as well at Car Insurance Ally. Power equals money. And our #1 priority is putting the power to compare and the power to choose in your hands. Because when you choose to make smart choices, you avoid expensive policies and a huge waste of money.

And to be brutally honest, that’s what the insurance companies want. The less you know about how policies work and what all that “legalese” means, the more likely you are to spend more money on programs that aren’t even relevant and add-ons that have nothing to do with your current needs.

Big insurance carriers feast on ignorance. They know most people don’t want to invest the time or effort into researching multiple insurance companies and sifting through all the data. But studies show that when you compare insurance quotes online for automobile protection, you can save as much as 50% on your policy costs! Imagine that, it’s like getting a free year of insurance compared to your current rates. The best part of it all? It’s 100% free to put the insurance companies against each other for your business.

Ready for some more mind-blowing match? There are close to 1 MILLION policies available across the largest of carriers. Not the 4 or 5 they try to steer you towards on their websites.

Do Your Homework

Never go onto an insurance company’s website without knowing what sort of coverage you want first. You’ll find yourself in the scenario where you’re trying to fit a square peg into a round hole, and end up sacrificing some of what you want for what the insurance company is trying to sell you.

Once you’ve got exactly what you want from a policy, then you can proceed in getting quotes to compare the policies that different companies are willing to offer you. There is simply no other way to find the best policy for you and the company that is willing to offer it for the best price.

The “what” and “who” of your current situation don’t really matter. They are just obstacles to overcome in crafting the perfect policy. We have the ability to sculpt the perfect plan regardless of what sort of coverage you’re in need of, be it collision, rental car, liability, or comprehensive. Have you been classified as high risk after a DUI conviction? Does your state require you to acquire an SR-22 document? We can work with you to provide exactly what you need at an affordable rate.

Always make sure you’re looking at the bottom line when you’re comparing quotes. Insurance companies will try to dazzle you with special discounts, unique deductibles, and flexible length periods, but all that matters is the policy and how much it’s going to cost you.

Don’t Settle For Less than the Best

They don’t put a ball and chain around your leg when you agree to an insurance policy. There’s not a priest letting you know it’s “til death do you part.” Sometimes it can feel like you’re locked into a certain rate with a certain company, but that’s just what they want you to believe!

Life is all about change. Maybe you get a better job and want to get better insurance to boot. Maybe the economy takes a downturn and you have to pull your purse strings tighter. Things change over time and if you’re not keeping an eye on your policy you might not realize when it turns from a low-cost deal to an out-of-control nightmare.

At Car Insurance Ally, we make sure that the price you pay now stays in place. When you compare quotes online with us, you’ll always find the best prices, usually in less time than it takes to make a cup of coffee.

The C.I.A Difference

Every insurance comparison site will tell you they’ve got the best deals on policies, but most of them are working directly with those same big companies that only care about the bottom line. At Car Insurance Ally, we value our customers and their satisfaction more than anything else, which means valuing your data and details first and foremost. Most comparison sites ask for your email address and phone number to sell it on to third parties. If that’s not a betrayal of your trust, we don’t know what is. Personal information is personal for a reason. We use yours to give you the very best service we can provide.

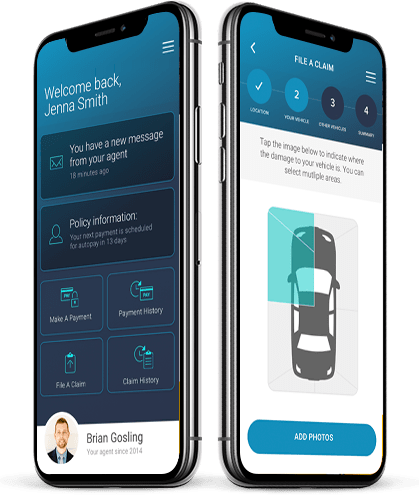

How We Do What We Do?

It starts with technology that we built ourselves for one purpose: Using our online platform to collect as many data points from every possible insurance provider in the country in order to generate the best possible connection between our users and all existing auto insurance policies.

This isn’t just a grab-and-go technique. No, our platform takes your input and combines in with more than 50 researched data points to develop a client profile that is unique to you. The data points include information from public sources of information that we perform statistical analysis on to develop actionable protocol.

From there, it is the relatively simple process of matching each consumer’s needs to the best possible insurance policy, keeping in mind at all times that our focus is on your price point and the value you want to achieve.

In A Nutshell

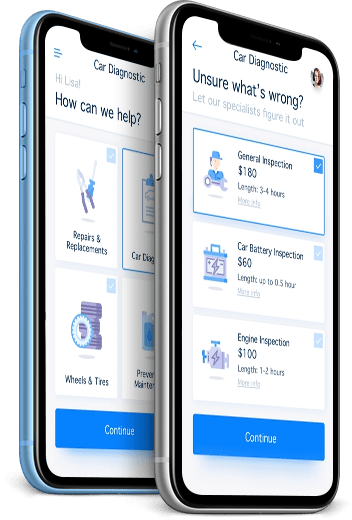

Auto insurance should not be confused with brain surgery. It should not confuse you or frustrate you. We believe in keeping things simple. If a policy is a rip-off or designed to drain your bank account, we simply do not show it. Our technology uses a form of Artificial Intelligence (AI) to learn patterns, see repetitions and make predictions accordingly. If a policy is not good for the customer or he can’t save money with it, we don’t show it. Our software learns the significance of patterns and is able to foresee repetition and turn it into prediction. This allows us to serve the needs of both our clients and the insurance companies, finding a happy middle point where they both come out as winners.

Why waste another minute? Get started right now and see how much money you can save on your auto insurance policy!

Get Started